We’re excited to announce the release of the new version of MacroTrader.

As you know, we are striving to make MacroTrader the best app to trade real-time economic news.

Our developers spent the last months hidden in their caves working on a whole array of new features for MacroTrader.

Now we are happy to present you the results. Here’s an overview of the newest features:

- MultiStrategies – build strategies for several events at once

- Separate Feeds – trade two simultaneous events with separate strategies ( eg NFP and Canadian Employment numbers)

- Retracement EA – a new strategy that uses the power of Fibonacci retracements in conjunction with news events

- Upgrades for FX BOLT EA – several new features for the main EA

- Presets for all Strategies

- Several minor bugfixes

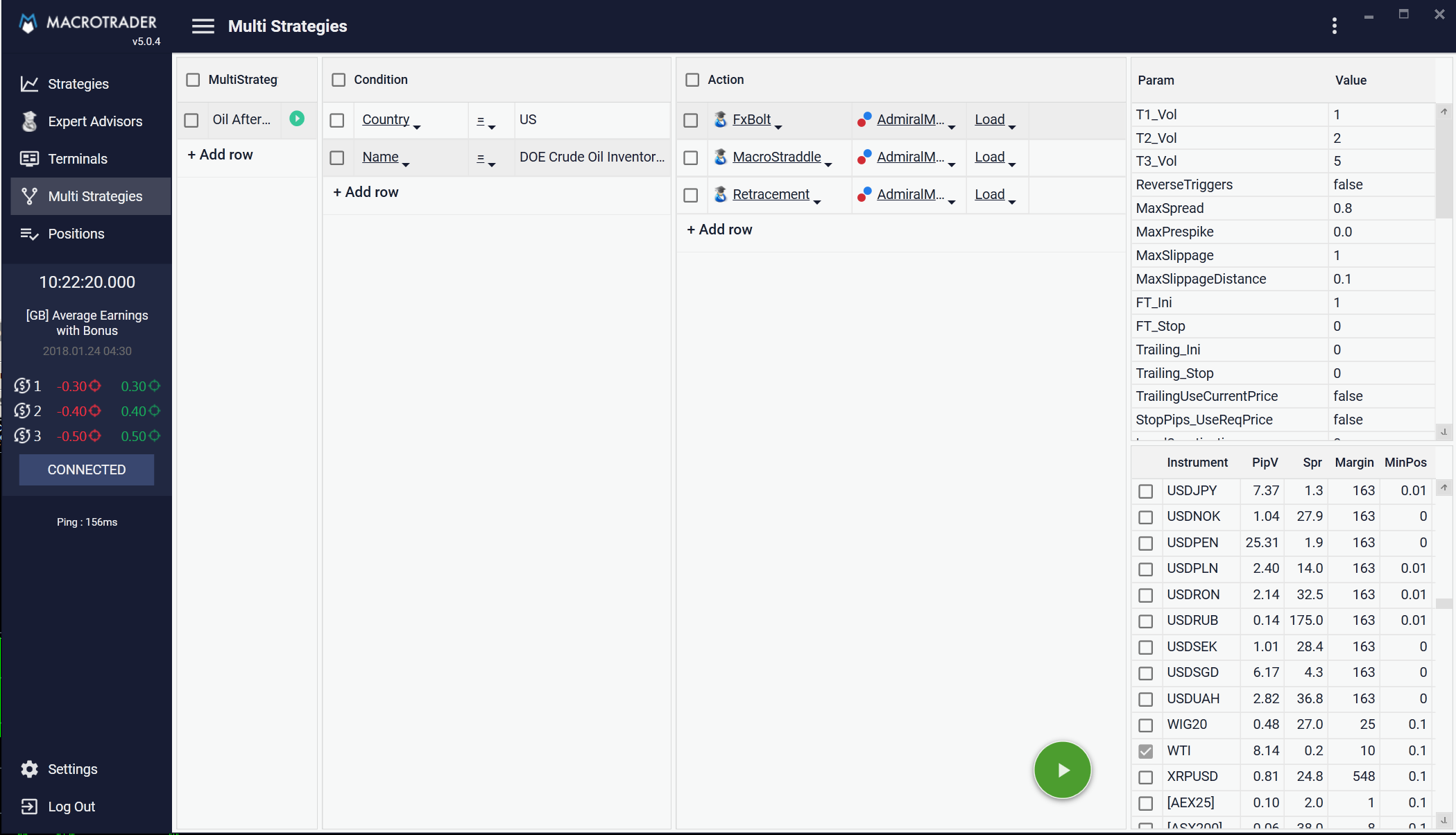

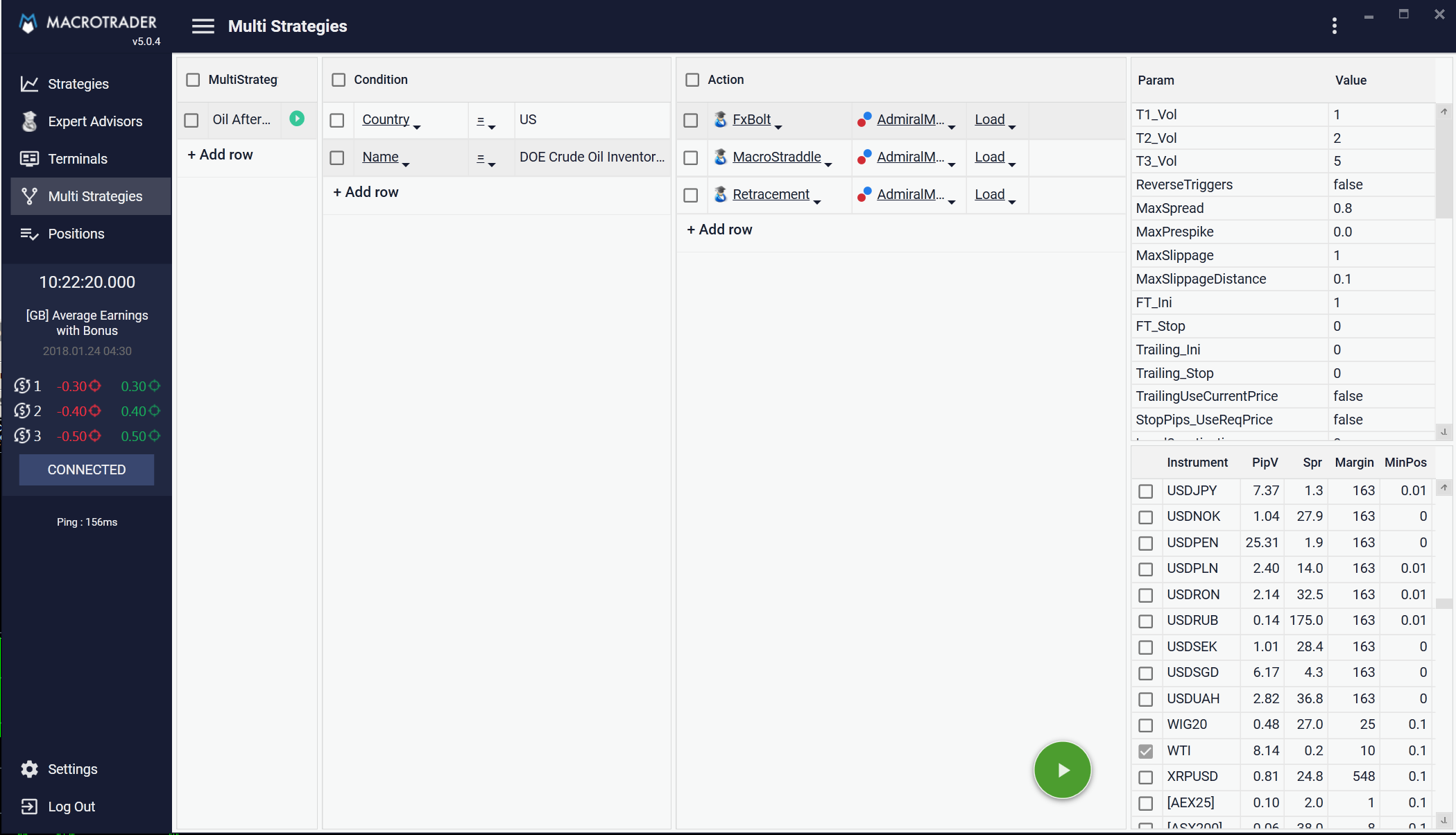

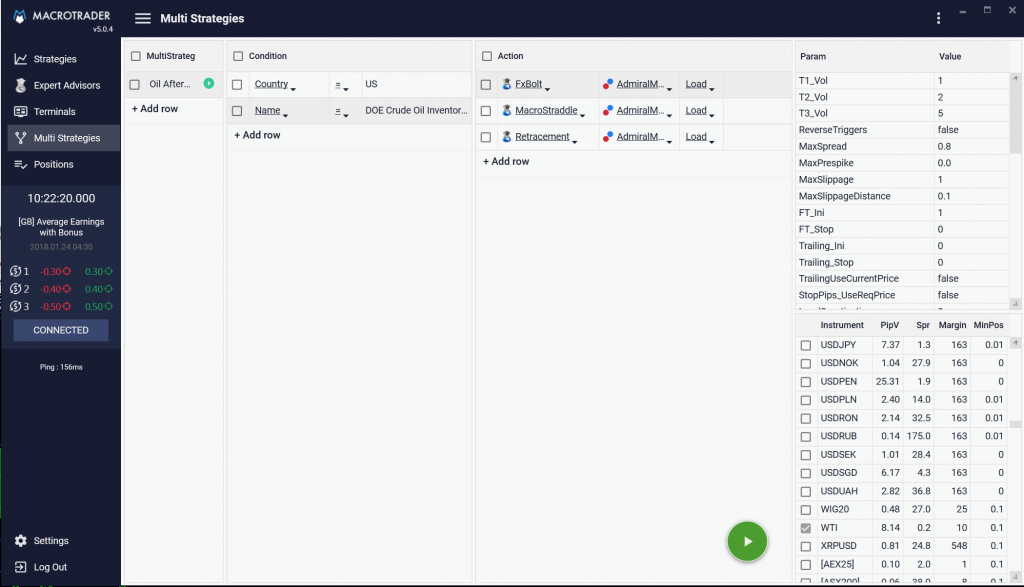

MultiStrategies

MultiStrategies grew out of the desire to simplify and speed up the process of setting strategies. We wanted to offer a straightforward process to set strategies for several events at once. Also, we wanted to make it easier to test brokers without having to build a strategy for every event. In our previous version, if you used the same strategy/broker at the weekly DOE Crude Oil Inventories you still had to create and set a strategy every week the event occurs.

With MultiStrategies, you can set conditions when a certain strategy should be loaded into your terminal. These conditions can be event names (ie DOE Crude Oil Inventories), countries (ie US) or even things like anticipated risk or performance. Once an event meets the requirements it will be automatically loaded.

This is also helpful if you want to test a broker – let’s say on every Australian release. Set the country condition to AU and build your strategy. Now you will execute the same strategy on each Australian release.

This feature enables long-term strategy building. Trading professionally is about finding a strategy with an edge and executing it over time. MultiStrategies helps you follow your own rules.

Other use cases are strategy building for a continuous anticipation of high-performance entries, like interest rate announcements. Interest Rates are exceptional cases in the Forex world. A surprising interest rate announcement has massive effects on markets, usually for hours or days to follow. The problem is just people don’t expect them and don’t have a strategy present when they happen.

If you set your MultiStrategies for an interest rate announcement (for example for CA Interest Rate) you can be sure that every time the BoC releases their interest rate, MacroTrader has a strategy loaded. So when the central bank surprisingly changes their interest rate, you will execute a trade.

Additional Feed

Of all features we’ve added, this was certainly the most requested: We’ve added a version of the FX BOLT EA and the Retracement EA that run on a separate feed and allow us to trade two events simultaneously. For example, US Non-Farm Payrolls and Candian Employment Change happen regularly at the same time. In order to trade the secondary event, we’ve added two EAs “FXBoltEA_AltEvent” and “RetracementEA_AltEvent” to the MacroTrader. If two events happen simultaneously, our users will be notified which event will be the primary event and which will be traded on the alternative feed.

Retracement EA

Our personal favourite is this new strategy. The new EA enables MacroTrader users to time their entries in a new way. This strategy does not to enter during the illiquid phase of the initial spike. Instead, it waits until the spike is overextended and retraces from its initial highs. Very often the typical market reaction will be to fall back before continuing into the direction of the initial spike. Our analysis found this closely related to Fibonacci retracements. The strategy aims for entering at these high probability reversal points (although it can certainly be used with any other percentage, too). If you would like to read more about the Retracement EA you can find many questions answered in our Knowledge Base.

We are currently working on a major upgrade for MacroCharts, that enables the collection of massive amounts of metadata for pattern analysis to further improve entry and target setting. You can expect a lot more to come here!

FX BOLT Upgrades

The FX Bolt received numerous upgrades: We’ve added the MaxSlippage feature. Since slippage is the biggest enemy of spike traders this parameter should help you limit your risk quicker and easier. The feature consists of two new parameters: MaxSlippage and MaxSlippageDistance. MaxSlippage allows you to set a maximum number of pips you will allow your order to differ from the spike start. If you are slipped more than that your SL automatically tightens to the smallest value allowed by your broker. In addition, MaxSlippageDistance can extend the distance you would like to move your SL away from that minimum level (read more here).

Also, we added a feature to set your SL relative to the spike start. While generally SL will be based on the entry price of your order, this feature can be used if you want to use your position to enter into a longer-term trade and qualify the spike start as a breakpoint. It is extremely interesting when combining the abilities of MaxSlippage and this feature. It allows a wider SL if your entry is at a good price while tightening SL when you receive too much slippage.

Presets

Upon user request, we added several presets to our strategy list. The EAs are complex and it is not always easy to set it just the way you want. These presets are designed to make it easier for you to make a strategy according to your specifications.

How do you like the new features of MacroTrader? What would you like to see in the future? Are there certain presets or additional strategies we should add? Let us know in the comment section or send us an email. We would very much like to hear from you.