How to trade the news with the spike

Knowing how to trade the news on important macroeconomic events can set you apart from the crowd. You can categorize news spikes as volatility events. These spikes can either be short or long-lived, depending on the market environment. You can think of news events as catalysts.

When buyers and seller and not sure about the direction of the market, economic data can decide which way markets are heading. Generally, there are only 2 possible trading scenarios: either the market continues to trade in the direction of the surprise. Thus, into the direction of the initial spike. Or, it can reverse to the mean and fade the spike in order to close the spike gap.

Note, how the price of GBP/USD is trending into the direction of the spike following the GB Core Retail Sales numbers. The initial spike starts at 1.3512 and ends at 1.3562. Within a few minutes, GBP/USD crossed the 1.3600s. Almost 100 pips. This is a momentum type of spike trade. But, how do we actually trade the news with this economic indicator?

Depending on market liquidity, you can enter the trade immediately as soon as the fresh data is released. Then, wait for further momentum to ride the trend to either a technical level, a round number, or a fixed distance from entry. Or some other price level you think is important.

How to trade the news with the spike II

Here is a second example of an afterspike continuation trade on GBP/USD following a surprise in inflation numbers. Inflation was forecasted at 2.8. But surprised with a 2.9 reading and the British Pound rallied substantially. 70 pips within 20 minutes.

Professional traders anticipate the future of the monetary policy and central bank decisions. They act immediately on surprising surprises. That is why we have these event-driven rallies.

How to trade the news against the spike

When markets are not ready to advance, but an economic indicator surprises to the upside. What happens usually is that the news is quickly digested. The financial instruments spikes to the upside. Only to be sold off immediately. This is called fading the spike or closing the spike gap. Here is an example of a quick spike fade.

How to trade the news against the spike II

There are economic reports with a short release cycle. Crude Oil inventories or Natural Gas storage are released once a week. What you can observe in many instances is the tendency of these reports to fill their gap. See how the spike move is reversed within 20 seconds.

In a recent blog post, we talked about the 9 ingredients of a successful trading plan.

We learned that you need to have a trading plan that tells you

- WHEN TO TRADE

- WHAT TO TRADE

- HOW MUCH TO TRADE

- HOW TO ENTER

- HOW TO EXIT A TRADE AND

- HOW TO EVALUATE RESULTS

Trading is taking actions in times of uncertainty. Future outcomes cannot be predicted by anyone with 100% accuracy. But, the better traders judge the probability of something to happen, the more money they will make. High-probability trade setups minimize the likelihood of bad trading decisions.

How to trade the news at the right times

You need to be sure to trade when the time is right. MacroSpike strategies are built around times when economic indicators are released and volatility is expected to be abnormally high. These events are scheduled in advance and have a binary outcome.

Either you will have a trade signal or not. There is no second-guessing. But the following is important to understand. You should only trade when the expected volatility is likely to be very high at scheduled dates. Only then, you can predict the market reaction with great probability.

You can make many mistakes when trading. In fact, overtrading for many people is their biggest obstacle to success. It is really best to find a pattern in the markets that can be repeatedly taken advantage upon. If you have confidence in each and every trade setup, trading gets so much less stressful.

The bread and better trades will be the ones that will seem almost too simple and mundane but will add significantly to your bottom line over time.

How to trade the news with the right instruments

Not all currencies and futures contracts have the characteristics that we need for high-probability trade setups. You should only consider trading instruments that will react in a predictable manner to market-moving events.

That means that you can predict with great probability that a certain deviation will lead to a certain minimum spike size. If the spike is not predictable, there is no reason to trade it. In addition, look for low transaction costs. Illiquid currency derivatives can have too big spreads. These cannot be viable candidates.

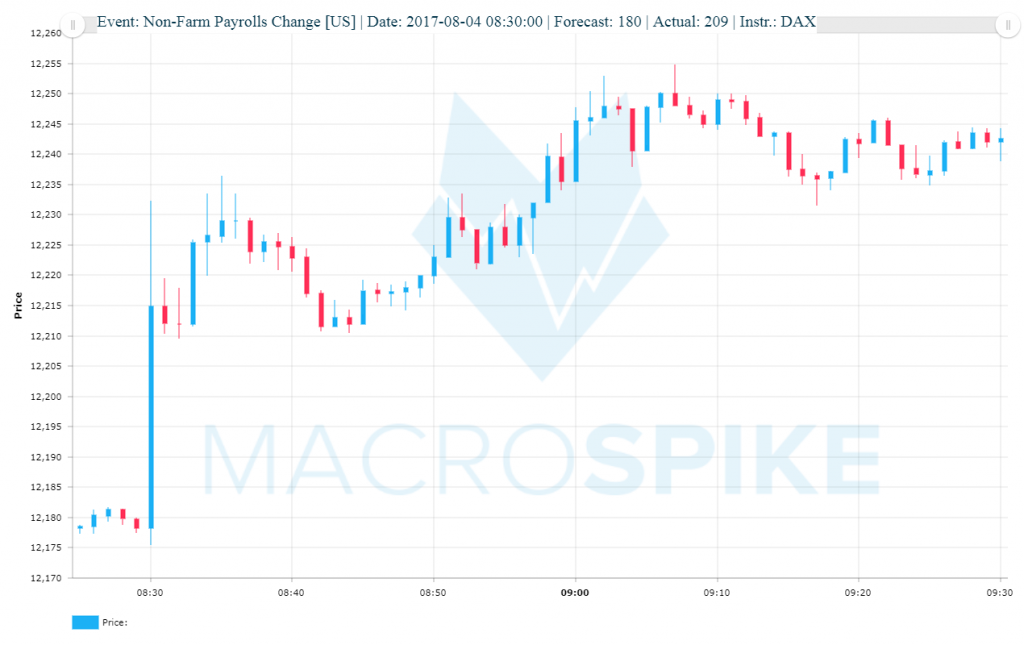

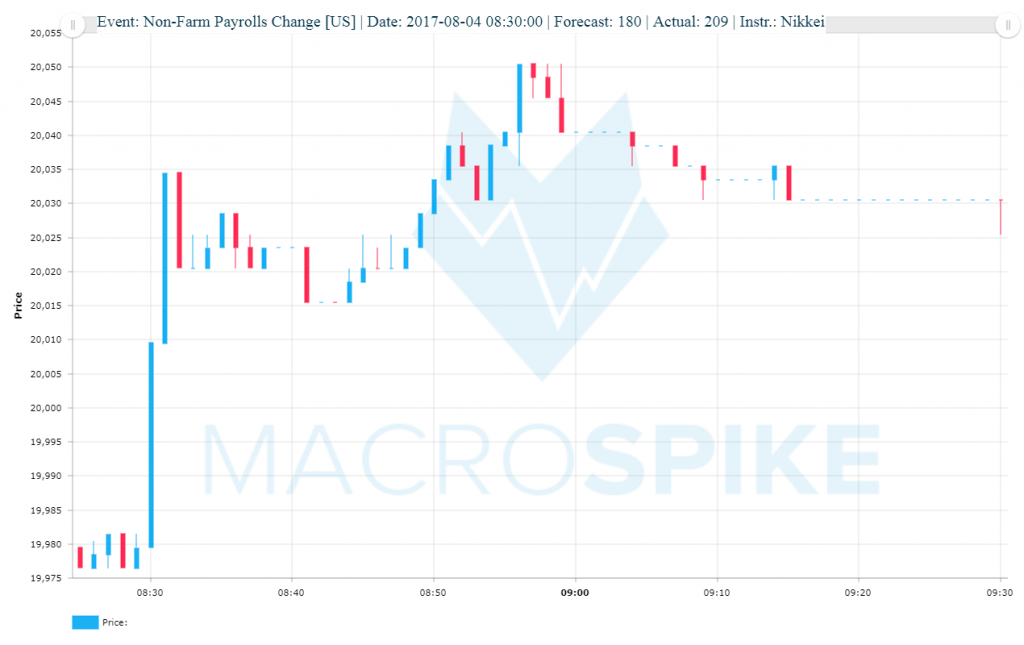

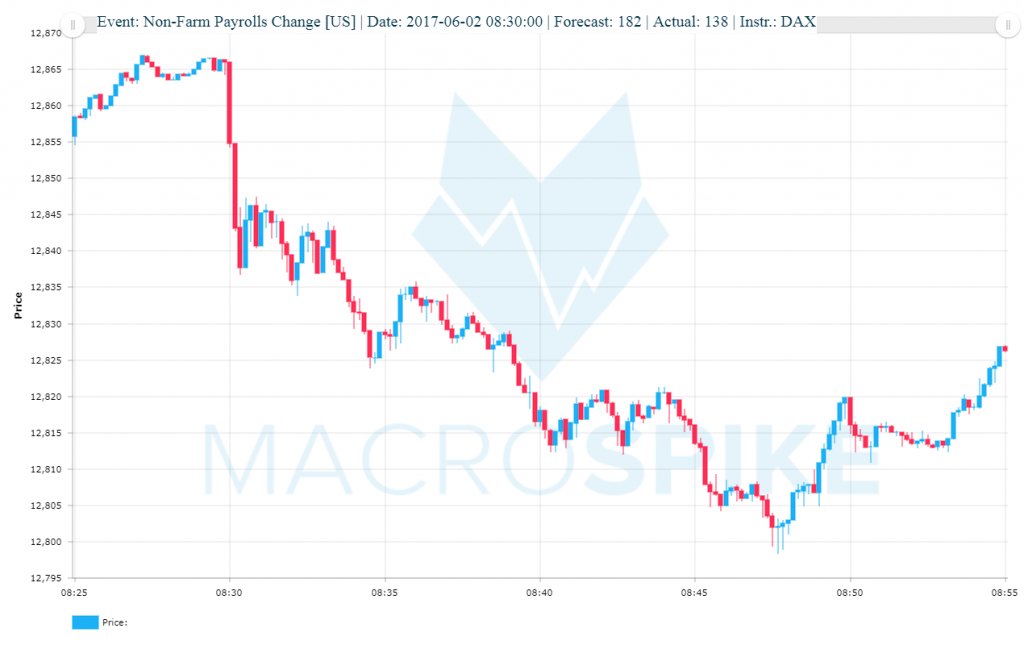

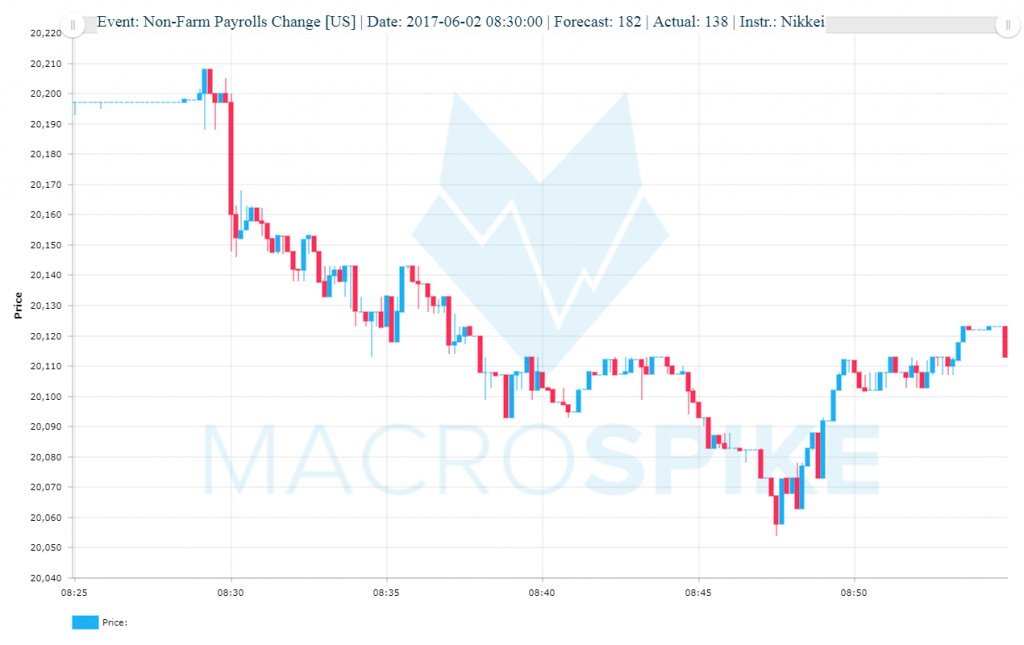

Taking US news events as an example. These events will not only impact the US DOLLAR as the underlying currency but also international stock markets like the German DAX30 Index. the Japanese NIKKEI and the French CAC40. You will see spikes on international commodity futures like GOLD or SILVER.

Also fixed income markets like the US 10-YEAR NOTES and the US 30-YEAR BONDS can move drastically. The web of international financial markets is highly connected and movements in one asset class are mutually dependent on moves in other asset classes.

How to trade the news for US Non-Farm Payrolls

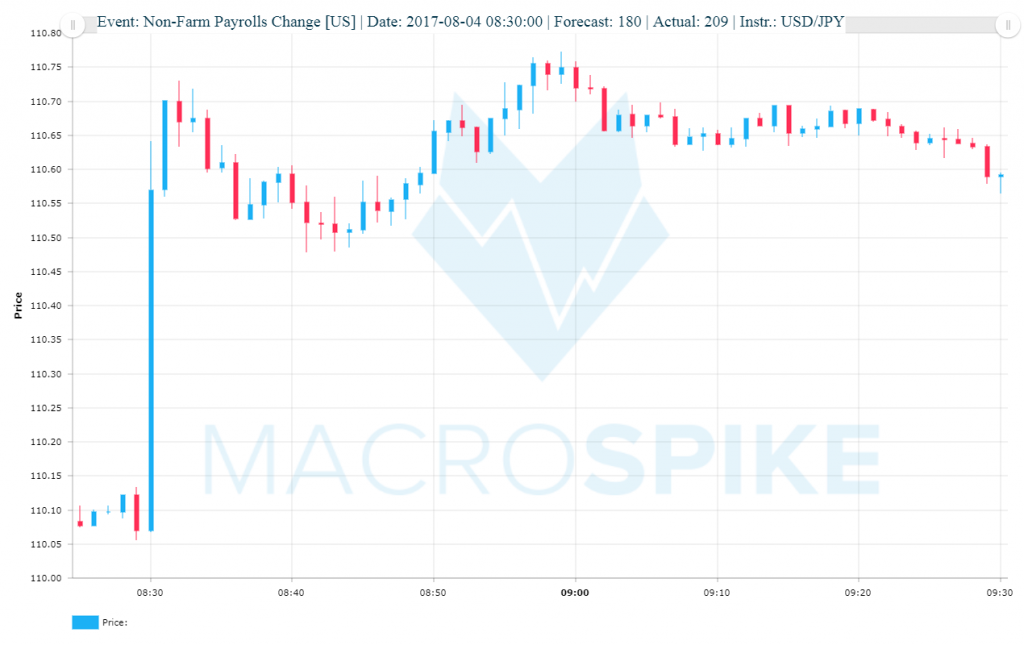

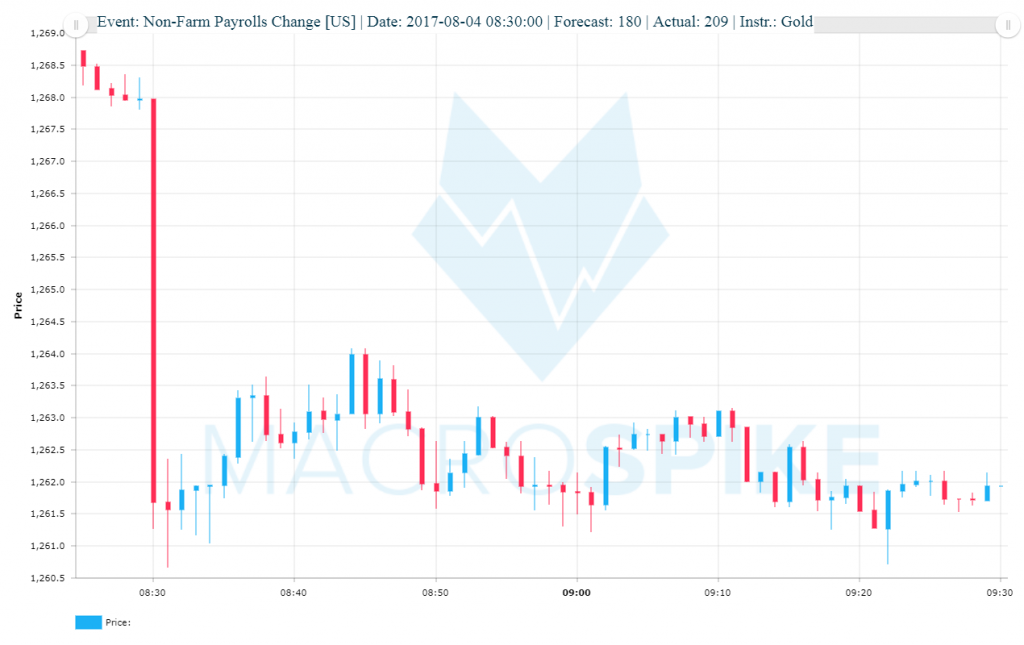

The following charts show market reactions to the US Non-Farm Payrolls at 08:30 on the 2017-08-04 for USD/JPY, GOLD, DAX and NIKKEI (in that order). There was a big movement in the USD/JPY currency pair that was mirrored by GOLD Futures.

See how the German DAX and the Japanese NIKKEI have highly correlated spike moves.

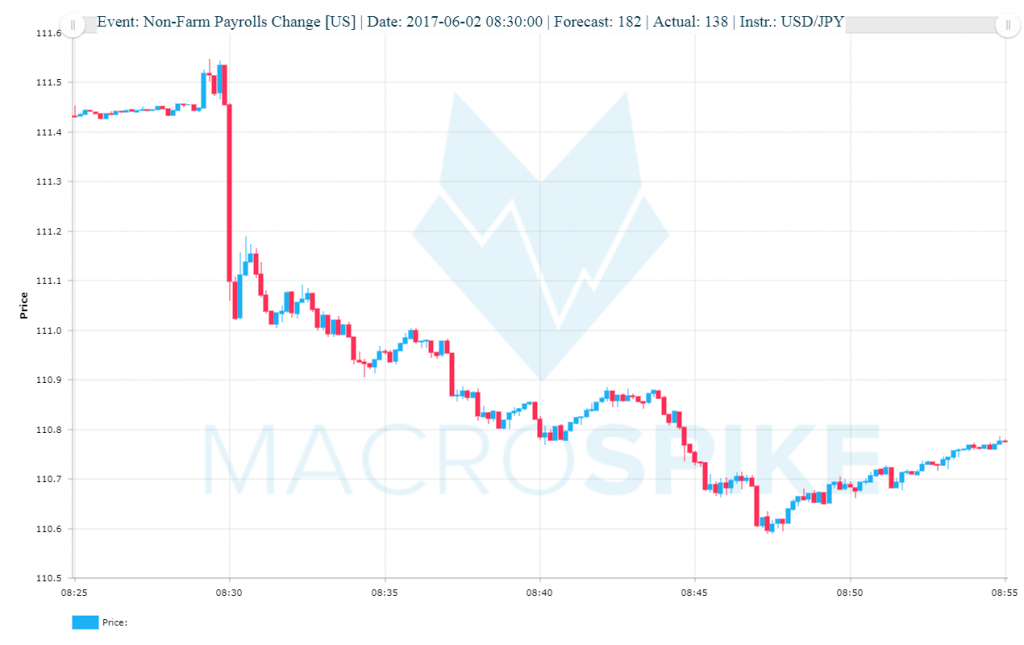

The US Non-Farm Payrolls reacted similarly on the 2017-06-02.

The instruments are in the same order for easier comparison: USD/JPY – GOLD – DAX – NIKKEI. Here we go.

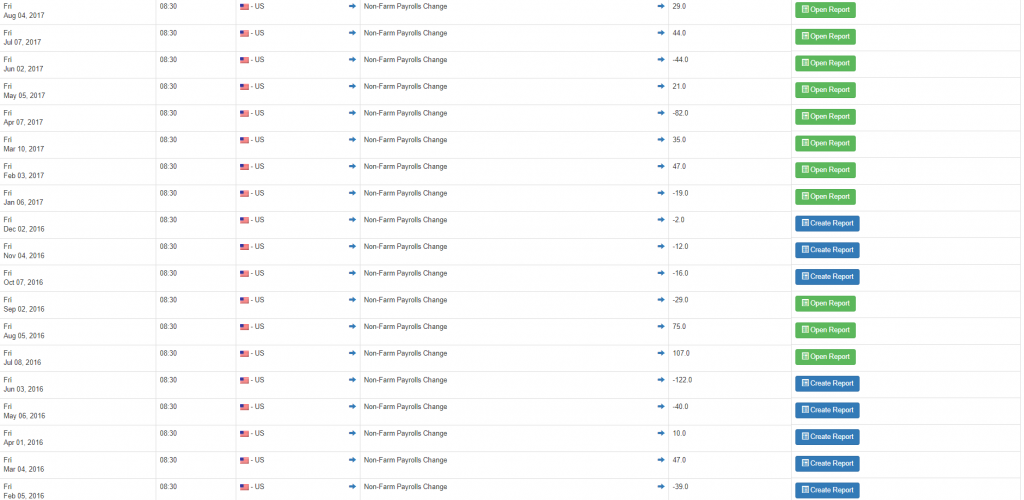

Many Economic indicators are being released either weekly, monthly or quarterly. Most events are released once a month. These release cycles limit the frequency of trades to either 52, 12 or 4 trades per year per given event.

The Change in Non-Farm Payrolls is a monthly event with 12 events per year as shown below.

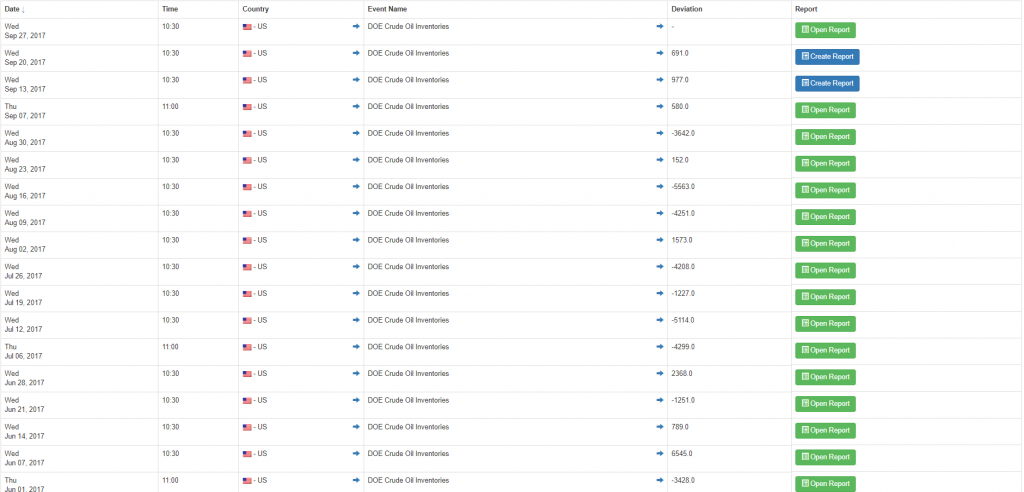

How to trade the news for US Crude Oil

Other events like the US DOE Crude Oil Inventories and the US Natural Gas Storage are released once a week, 52 times a year.

There is a statistical correlation between the deviation of economic data from analyst forecasts and the estimated market reactions. We need this predictability for our trading systems to be robust and reliable.

In the first event example, the deviation from forecasts is 29. The 2nd event deviated by -44. In both cases, the USD/JPY moved by more than 60 pips within 5 minutes. Therefore you can estimate that a deviation of 30-45 will bring ~60 pips in 5 minutes. This example is pretty simple in nature.

But it is just here to illustrate the logic that goes into trading the news:

Reactions to economic events can be predicted with high

probability giving event-driven traders a competitive edge.

Event-driven Trading on macroeconomic news

Event-driven traders look for information that yet needs to be digested by the market. New data often increases short-term market volatility and initiates longer-term price trends. If the news is better or worse than expected, discretionary traders and algorithms will notice and act immediately.

Traders with a fast data feed have an advantage over other market participants. They can enter the market at the same time (or few milliseconds after) when the news is out.

Macroeconomic news is released by countries worldwide and impacts underlying currencies. Stock, futures and bond markets move immensely, too. Manifold investment companies use news events as a means to exploit market inefficiencies.

Event-driven funds invest in many liquid asset classes including currencies, equities, and government bonds. There are many different profitable event-driven strategies.

Macroeconomic news events give traders

with a fast news feed an informational edge.

How to trade the news and manage risk

You need to understand and manage risk as a trader. On any given trade you should roughly know the amount you have at risk.

Gold Futures often show a nice reaction to US news with initial spikes sizes of $2 – $6. The above-given Gold spike for the US Non-Farm Payrolls on the 2nd of June 2017 is $4 big ($1263 – $1267) and right in the middle of our estimated range.

When choosing a stop loss order, be sure to go for a reasonable value that is no bigger than the expected average spike.

For an expected average spike of $2, the stop loss does not need to exceed $2.

Take $2 now as your stop loss amount (or $1 or $0.50 etc) and do not allow for more than 3-5% risk on the trade. Now determine your maximum position size. This certainly depends on the size of the trading account.

Traders with bigger accounts can take greater position sizes, but percentage-wise, risk should not be greater than 3-5% on any trade.

Your take profit order should be a multiple of the given stop loss. With a 2:1 reward-to-risk-ratio go for a $4 take profit at least. Know your approximate reward-to-risk-ratio before entering a trade. Hence, how do you determine the optimum ratio?

A static approach with fixed 3:1, 4:1, 5:1, etc ratios might work for you. Whereas more dynamic techniques that take technical and/or fundamental factors into account might be a better choice for others. Try to trade one approach and master it. Instead of jumping back and forth without clear direction.

How to enter a news trade

When you place trades with a foreign exchange or futures broker, it is crucial to know how to place them properly and how to work on your entries to get better prices with lower transaction costs. There are several order types that control how to enter and exit markets.

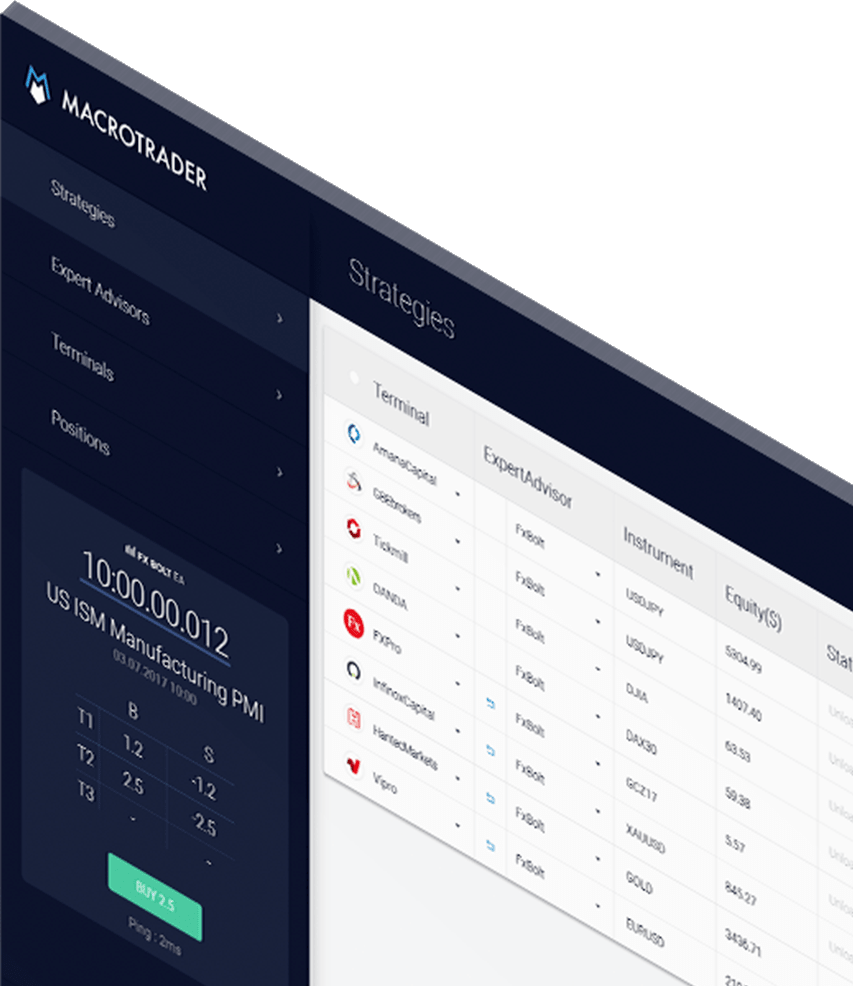

FX BOLT and the FX BOLT EA for MacroTrader use market orders for getting into a trade.

With market orders, you execute buy transactions at the current asking price and sell transactions at the bid of the market. These orders are considered the riskiest by some, but that does not have to be the case if you know how to properly make use of them.

MacroTrader can limit the potential spread and slippage on a trade as well as stay out of the market in the case of rare, but dangerous prespikes. These are premature market moves induced by news leaks.

MacroStraddle utilizes stop market orders in order to catch potential breakouts. You can activate these orders at-market once a predefined target price is reached. If USD/JPY is trading at 100.00 and the stop market order is placed at 100.10, this order will turn into a market order once the asking price of the Dollar-Yen-cross reaches 100.10.

Though MacroStraddle can be used in tandem with the FX BOLT strategy on economic data, its true strength is capturing volatility breakouts from speeches, elections, referendums, etc. Generally said: all events with a huge trading interest and potential big market moves.

Exit Techniques

Exiting a trade is at least as important as entering a trade. A trading strategy cannot be complete without a proper plan to getting out of a trade. You need a good exit strategy to minimize potential losses and lock in profits periodically or at fixed intervals.

It is common practice to use stop market orders to close positions since they will guarantee you an exit when you most need it. Stop orders and Take Profit orders are basically one of a kind: they exit a trade either at loss or at a profit.

A stop loss order closes a position with your broker automatically at a predefined price level, at which the stop order will be converted to a market order in order to sell out of the position.

You should know about your exit strategy already before entering a new trade. Your exit strategy should consist of definite price and/or time levels at which the trade will be closed either partially or entirely, either manually or automatically. The exit strategy is closely related to the position sizing part of the trading plan by having price or time targets that influence the possible size of the trade.

Taking Profits

So how do you know at which levels to take your profits?

Going back to the GOLD Futures trade example we talked about earlier: if trade and events statistics show an average reaction of GOLD in the amount of $10 to a certain economic event at 20 minutes into the report, we could construct an exit strategy with a take profit order at $8 and also have a time stop order at 20 minutes.

This would close out the trade in profit if either GOLD moved $8 or 20 minutes have passed. This is an example of clearly thought out exit points that reduce emotions and automate trading decisions.

Other exit strategies might have levels of support and resistance, Pivot Points, Fibonacci levels as target points so that trades are liquidated once these levels are reached.

Trailing stop orders trail profits at a fixed distance from the current market price. At 20 points, a stop order will be activated once the position is 20 points in profit. Every 20 points, profits will be trailed in 20-point-steps, so that the position will only be exited once the price retraces by more than 20 points from highs.

CONCLUSION

If you want to trade successfully. you really need to understand risk and probabilities. You need to Identify exploitable profit opportunities and take advantage of them in a risk-controlled manner. Trading the news presents many profit opportunities both for day and swing traders.

Being ready to pull the trigger when the market is set up for big price moves and doing this repeatedly, is setting traders up for success.

Gordon Gekko, the protagonist of the 80s movie “Wall Street” knew it all when he said, “information was the most important commodity when trading.” Reactions to economic news events are predictable. Markets act on the surprise factor. Big market surprises lead to big market gains.

3 Comments. Leave new

Very nice article!

Hi, very nice post. I was looking for something similar to this. Thanks for this useful information.

Nice article. Its realy nice. Many info help me. dont stop the super work!